The Future of Crypto: Fortune 500 Companies Embracing Blockchain Technology

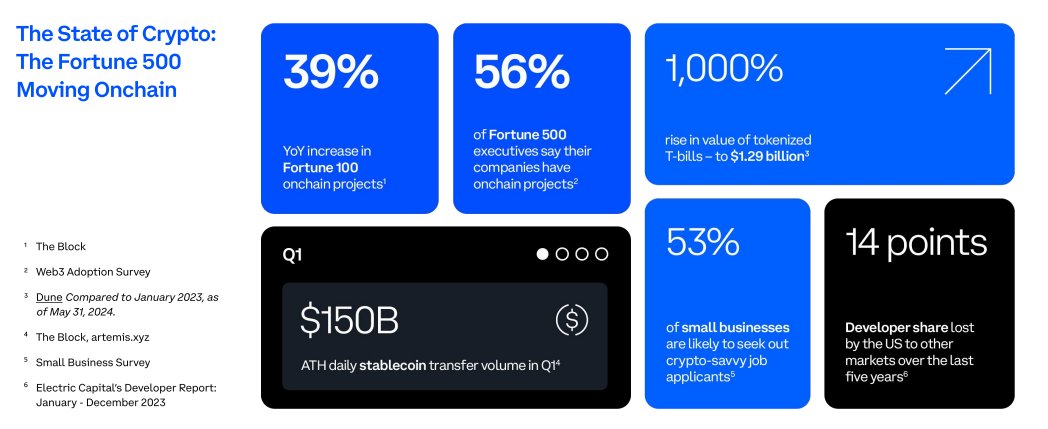

America’s leading public companies are increasingly adopting blockchain technology, with onchain projects announced by Fortune 100 companies rising by 39% year-over-year, reaching a record high in Q1 2024. A survey of Fortune 500 executives reveals that 56% of their companies are engaged in onchain projects. From established legacy brands to small businesses, the integration of stablecoins and tokenized T-bills signifies a widespread embrace of blockchain and cryptocurrency. This surge in activity highlights the pressing need for clear regulatory guidelines to retain crypto developers and other talents within the US.

Research conducted for Coinbase by The Block indicates that cryptocurrency, blockchain, or web3 initiatives announced by Fortune 100 companies have surged by 39% year-over-year, hitting a record high in Q1 2024. A survey of Fortune 500 executives shows that 56% report their companies are working on onchain projects, including consumer-facing payment applications. This increased activity underscores the urgency for clear crypto regulations to keep developers and talent in the US, realize crypto’s potential for better access, and enable US leadership in the global crypto space.

Prominent financial institutions are increasingly integrating blockchain technology and crypto, driving innovation and facilitating broader adoption:

- Spot Bitcoin ETFs: There is significant demand for spot bitcoin ETFs, with total assets under management surpassing $63 billion. The SEC approved exchange applications to list and trade spot ether ETFs on May 23, 2024, pending S-1 approval, further scaling access to spot crypto in familiar products and spurring adoption.

- Onchain Government Securities: High interest rates have boosted demand for tokenized T-bills, with the value of tokenized US Treasury products increasing over 1,000% since early 2023, reaching $1.29 billion. BlackRock’s tokenized US Treasury fund BUIDL, valued at $382 million, recently surpassed Franklin Templeton’s $368 million fund to become the largest. By 2030, the tokenized asset market is expected to reach $16 trillion, equivalent to the EU’s GDP today.

- Stablecoins in Payments: Coinbase, PayPal, and Stripe are enhancing the usability of stablecoins. Through Circle, merchants on Stripe can accept USDC payments via Ethereum, Solana, and Polygon, with automatic fiat conversion. PayPal supports cross-border stablecoin transfers in about 160 countries with no transaction fees, compared to 4.45% to 6.39% in the $860 billion global remittance market. In 2023, stablecoins had an annual settlement volume of $10 trillion, over ten times the global remittance volume.

The progress isn’t limited to top-down initiatives but includes grassroots efforts as well. Small businesses, widely regarded as the most trusted institutions in the US, are also venturing into crypto. Approximately 68% believe crypto can address at least one of their financial pain points, notably transaction fees and processing times.

Coinbase commends the progress of traditional finance (tradfi) in updating the financial system, emphasizing a few critical points:

- Talent Retention: The US must cultivate and retain essential talent instead of losing it overseas. The US’s share of crypto developers has decreased by 14 points over the past five years, with only 26% of crypto developers currently US-based. Among Fortune 500 executives, concerns about available, trusted talent are now a significant barrier to adoption, surpassing regulatory concerns. About half of small businesses are likely to seek candidates familiar with crypto for their next finance, legal, or IT/tech role. Clear crypto regulations are vital for retaining developers and ensuring the US continues to lead in technological innovation.

- Enhancing Financial Access: It’s crucial to ensure the technology fulfills its promise of better financial access for both crypto-using companies and underserved populations. Approximately 48% of Fortune 500 executives believe crypto can increase access to the financial system and wealth creation for the underbanked and unbanked. Additionally, banks can encourage innovation by finding more ways to work with companies using crypto.

- US Leadership: The US must assert leadership in this space. There is significant interest among Fortune 500 executives, with 79% wanting to collaborate with partners in the US (up from 73% a year ago), and 72% agreeing that a USD-backed digital currency is essential for maintaining US economic competitiveness globally.

Crypto represents the future of money. This research report, the fourth since June 2023, provides a year-over-year look at corporate adoption. It’s part of Coinbase’s ongoing campaign to educate the public about the role of crypto, blockchain, and other web3 technologies in modernizing the global financial system for the benefit of both corporations and consumers.

Methodology

Unless otherwise noted, the data and insights cited in this report are derived from the following sources:

- Fortune 100 Initiatives: Analysis of web3 initiative activity by Fortune 100 companies from Q1 2020 to early June 2024 by The Block Pro Research. “Activity” includes any digital assets/blockchain-related internal company projects, investments, partnerships, product/service launches, and similar initiatives. The Block conducted searches of publicly available information using keywords such as “crypto,” “blockchain,” “tokenization,” “NFTs,” “metaverse,” and “digital assets” across news sites, company filings, press releases, and announcements. Search results were manually filtered for relevance, aggregated, and deduplicated. Each initiative in the resulting database was assessed for stage, industry, and web3 use case.

- Case Studies: Research on Fortune 100, stablecoin, and tokenization initiatives by The Block.

You may also like

The Ultimate Guide to Using Trendlines Effectively

Regulating Crypto-Assets: MiCA Regulation